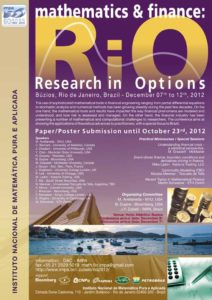

Research in Options 2012

Búzios, Rio de Janeiro, de 07/12 até 13/12, 2012

The use of sophisticated mathematical tools in financial engineering ranging from partial differential equations to stochastic analysis and numerical methods has been growing steadily during the past few decades. On the one hand, the mathematical tools and results have impacted the way financial phenomena are modeled and understood, and how risk is assessed and managed. On the other hand, the financial industry has been presenting a number of mathematical and computational challenges to researchers. The conference aims at showing the applications of theoretical advances to practitioners, with a special focus to Brazil.

This is the seventh conference hosted by IMPA’s group on Math Finance on the subject. It is a follow up of six highly successful previous ones. Each one had in its attendance about 100 participants evenly spread from academia and industry. This year we will focus on different aspects of option pricing ranging from fixed income and volatility trading to real options.

We will also have special sessions on risk management and portfolio optimization.

We will precede the conference with two days of minicourses. The minicourses will be aimed at practioners and students.

Deadlines:

Application for student support: October 31st, 2012.

Contributed Communications: October 31st, 2012.

Poster Submission: October 23rd, 2012.

Arrival, Departure and Transportation:

Transportation:

Transportation will be provided as follows:

Going to Hotel Atlântico Búzios – From Rio de Janeiro to Búzios

Friday – Dec. 07

Bus 1 – The bus will leave from IMPA (Estrada Dona Castorina, 110 – Jardim Botânico) at 3 p.m, on December 7. The trip takes about 3 hours.

Sunday – Dec. 09

Bus 2 – The bus will leave from IMPA (Estrada Dona Castorina, 110 – Jardim Botânico) at 3 p.m., on December 9 , Sunday.

Back from Búzios to Rio de Janeiro

The bus will leave Hotel Atlantico on December 13, Thursday, by 11:00 a.m, stopping at the International Airport, and then going to IMPA.

Certificates

Contributed Communications

Contributed Presentations Program

Hamed Amini

Contagious defaults in financial Networks

Fernando Cerezzetti

Arbitrage in Option Trading: A Bayesian Approach for Verification

Zhenyu Cui

Prices and Asymptotics for Discrete Variance Swaps

José Faias

Variance Improved Performance

Sergio Franklin

The option to delay network investment decision and its impact on the cost-based prices of regulated telecommunications services

Ruth Kaila

Pricing exotic options with an implied integrated variance

Arseniy Kukanov

Optimal order placement in limit order markets

Keita Owari

Maximum Lebesgue Extension Of Convex Risk Measures

Yuri Saporito

Multiscale Stochastic Volatility Model for Options on Futures

Gyorgy Varga

Mutual Fund Flow and Past Information: Is the Brazilian Investor Smart?

Lakshithe Wagalath

Fire sales forensics: measuring endogenous risk

Ruodu Wang

Bounds for joint portfolio with unknown dependence structure

Event Webpage

Hotel Reservation

Venue: Hotel Atlantico, Búzios

IMPORTANT: Reservations to get the group rate should be made through our travel agent (micheleleite@cmoeventos.com.br and eventos@cmoeventos.com.br). Please do make a copy to math.fin.impa@gmail.com of such communications.

Prices for the group

Single: R$ 385,00 + 15% (includes breakfast and lunch)

Double: R$ 470,00 + 15% (includes breakfast and lunch)

IMPORTANT NOTE TO INDUSTRY PARTICIPANTS: Please make your reservation asap. We cannot guarantee availability of hotel space for reservations after 09/11/2012. We urge you to make your reservation before this date.

IMPORTANTE: Reservas devem ser feitas o mais cedo possível. Após 09/11/2012 os quartos da reserva em bloco que efetuamos e que não foram utilizados serão liberados.

Invited Speakers

Marco Avellaneda (Courant Institute, USA)

Some Applications of Linear Programming to Managing Liquidation Risk

Carole Bernard (Waterloo, Canada)

Mean-Variance Optimal Portfolios in the Presence of a Benchmark with Applications to Fraud Detection

Amel Bentata (Universitat Zurich – ESILV )

Short time asymptotics for semimartingales and an application for short maturity index options in a multivariate jump-diffusion model

Marcos Carreira (BMF BOVESPA)

Ticks, coins and traffic lights: Choices in market structure

John Chadam (University of Pittsburgh, USA)

Optimal Prepayment of Mortgages

Youngna Choi (Montclair St. University, USA)

Sovereign Credit Risk Contagion: a Dynamical Systems Approach

Bruno Dupire (Bloomberg, USA)

The Proper Use of Derivatives

Paul Feehan (Rutgers University, New Brunswick)

Degenerate obstacle problems in mathematical finance

Matheus Grasselli (McMaster University, Canada)

Deficit spending versus austerity – the mathematics of government intervention in macroeconomics

Emmanuel Gobet (École Polytechnique, França)

Expansion formulas for average and spread options

Julien Guyon (Bloomberg, USA)

Stochastic Volatility’s Orderly Smiles

Lane Hughston (University College London, UK)

Signal Processing with Lévy Information

Roger Lee (U. Chicago, USA)

Vanilla-like Options

Terence Ma (South Street Securities, USA)

The Quiet Change That Rocked the World

Andreea Minca (Cornell, USA)

A game theoretic approach to funding liquidity modeling

Teemu Pennanen (King’s College London, England)

Indifference pricing in illiquid markets

Chris Rogers (Cambridge, UK)

The joint law of the extrema, final value and signature of a stopped random walk.

Martin Schweizer (ETH Zurich)

Constraints in quadratic hedging and portfolio choice problems

Minicourses

Matheus Grasselli (McMaster University, Canada)

Title: Understanding financial crisis – a statistical perspective.

Mike Lipkin (Columbia University; Katama Trading, LLC)

Title: Event-driven Finance.

Nicolas Merener (Torcuato de Tella)

Title: Commodity Markets: Structure, Empirics & Models

Martin Schweizer (ETH Zurich)

Title: Circling the square — A course around quadratic hedging and portfolio choice

Organizing Committee

Marco Avellaneda (Courant)

Bruno Dupire (Bloomberg)

Jorge Zubelli (IMPA)

Poster Session

Ewan Mackie (IMPA)

A Long-Memory Model for the Term-Structure of Commodity Futures

Jamil Chevitarese and Rodrigo Novinski (IBEMEC)

PCA Explanatory Power in Stochastic Interest Rate Models

Instructions for submit

We will hold a poster session during part of the evenings so as to encourage the contribution of research and projects currently developed by students. Posters should be sent to math.fin.impa@gmail.com using Poster Session as subject. The standard adopted for posters is size A0 vertical.

Deadline for submission of posters: October 23rd, 2012.

Program

Contributed Presentations Program

Registration

Price for Registration

| Category |

Price |

| Students | R$ 40,00 |

| Academic | R$ 200,00 |

| Industry (and others that are not in academy) | R$ 1.000,00 |

Registered Participants

Student Participation

Student participation from related areas to financial engineering and applied mathematics is highly encouraged. In order to encourage student participation a special fee was arranged. In order to qualify for such fee you must be able to provide a proof of current registration on an institution of higher education (“instituição de ensino superior” IES by Capes/MEC definition or by EU definition).

Deadline for application for student support: October 31st, 2012.

Venue: Hotel Atlântico Búzios

Postal Address: Instituto Nacional de Matemática Pura e Aplicada

Estrada Dona Castorina 110, Jardim Botânico

Rio de Janeiro, RJ, CEP 22460-320, Brasil

E-mail: eventos@impa.br