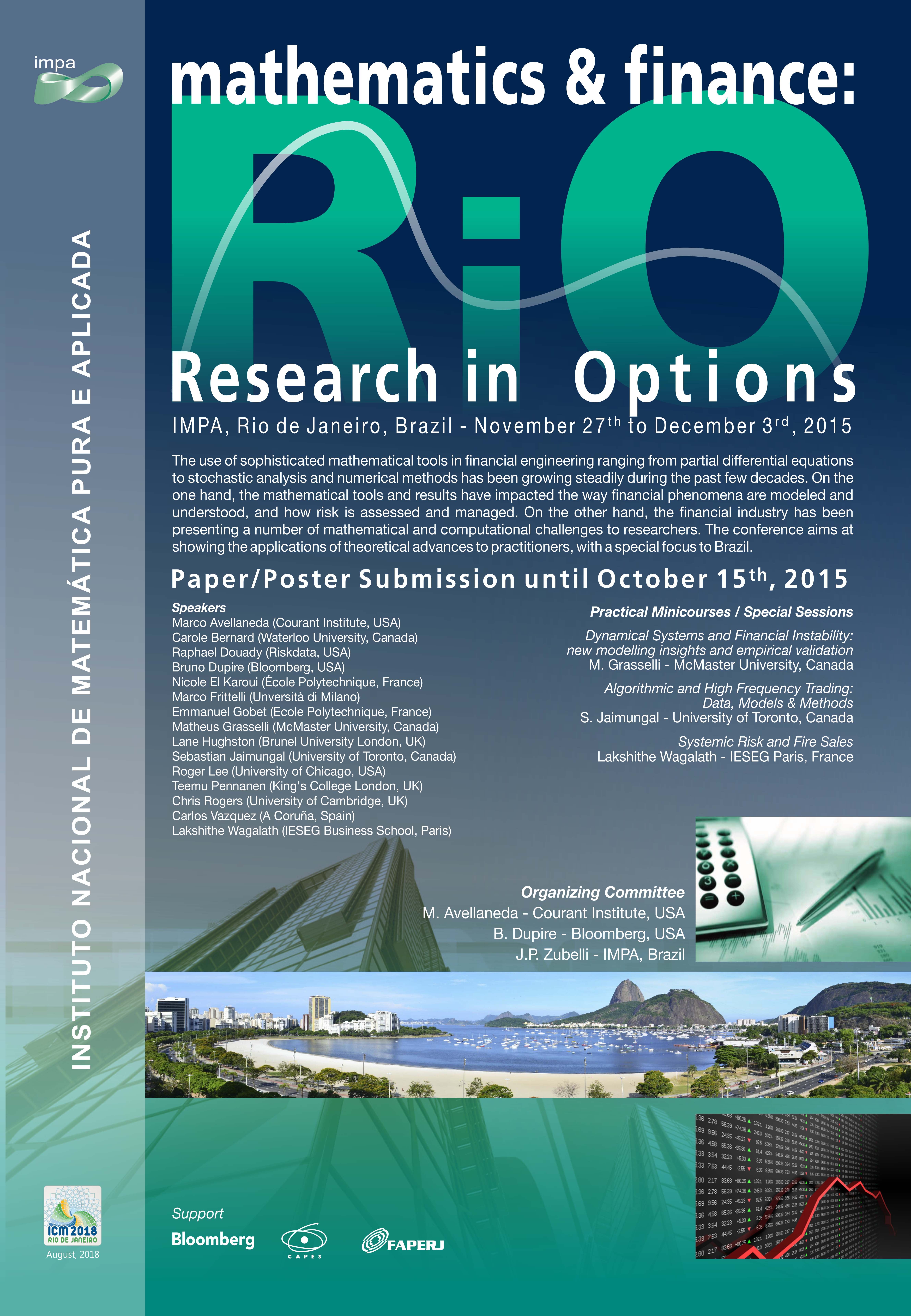

Research in Options 2015

IMPA, Rio de Janeiro, de 27/11 até 03/12

The use of sophisticated mathematical tools in financial engineering ranging from partial differential equations to stochastic analysis and numerical methods has been growing steadily during the past few decades. On the one hand, the mathematical tools and results have impacted the way financial phenomena are modeled and understood, and how risk is assessed and managed. On the other hand, the financial industry has been presenting a number of mathematical and computational challenges to researchers.

This is the tenth conference hosted by IMPA’s group on Math Finance on the subject. It is a follow up of the highly successful previous editions. Each one had in its attendance about 100 participants evenly spread from academia and industry. This year we will focus on different aspects of mathematical finance including (but not limited to) option pricing, fixed income, volatility trading, real options, commodities, algorithmic trading, portfolio and risk management.

We will precede the conference with two days of minicourses. The minicourses will be aimed at both practioners and students.

Videos

Youtube Playlist of the Lectures

Certificates

Committee

Marco Avellaneda – Courant Institute, USA

Bruno Dupire – Bloomberg, USA

Jorge Zubelli – IMPA, Brazil

Event Webpage

Picture of the Group

Program

Registration

Registration Fees (due upon arrival)

| Category | Fee |

| Students (Master and Ph.D) | R$ 50.00 |

| Academic | R$ 210.00 |

| Industry (and others that are not in academy) | R$ 1400.00 |

Minicourses

Matheus Grasselli (McMaster University, Canada)

Dynamical Systems and Financial Instability – New Modelling Insights and Empirical Validation

Sebastian Jaimungal (University of Toronto, Canada)

Algorithmic and High-Frequency Trading

Lakshithe Wagalath (IESEG, Paris)

Fire Sales and Systemic Risk

Speakers

Marco Avellaneda (Courant Institute, USA)

A Holistic (and Practical) Approach for Risk-Managing Portfolios of Equity Derivatives

Carole Bernard (Waterloo University, Canada)

Two- and Three- Fund Separation Theorems Under General Assumptions

Raphael Douady (Riskdata, USA)

Nonlinear Factor Analysis by Polymodels

Bruno Dupire (Bloomberg, USA)

Tradable Estimates of Historical Volatility

Nicole El Karoui (École polytechnique, France)

TBA

Marco Frittelli (Unversità di Milano)

Model-Free Superhedging Duality

Matheus Grasselli (McMaster University, Canada)

Inequality in a Monetary Dynamic Macroeconomic Model – Sorting out Piketty’s View on Capital

Lane Hughston (Brunel University London, UK)

Market Price of Risk: Facts and Fallacies

Sebastian Jaimungal (University of Toronto, Canada)

Trading Strategies Within the Edges of No-Arbitrage

Matjaž Omladič (Institute of Mathematics, Physics and Mechanics – Ljubljana)

What can Wikipedia and Google tell us about stock prices under different market regimes?

Teemu Pennanen (King’s College London, UK)

Indifference Swap Rates in Incomplete Markets

Chris Rogers (University of Cambridge, UK)

Bermudan Options By Simulation

Uwe Schmock (Vienna University of Technology, Austria)

Term structure of defaultable bonds, an approach with Jacobi processes

Carlos Vazquez (A Coruña, Spain)

PDE Models and Numerical Methods for XVA Computing

Lakshithe Wagalath (IESEG Business School, Paris)

Lost in Contagion: Building a Liquidation Index from Covariance Dynamics

Jorge Zubelli (IMPA, Brazil)

Project Evaluation Under Uncertainty: From Minimal Martingale Measures to Implementation

Poster Session

We will hold a poster session during part of the evenings so as to encourage the contribution of research and projects currently developed by students. Posters should be sent to math.fin.impa@gmail.com using Poster Session as subject. The standard adopted for posters is size A0 vertical. Deadline for submission of posters: October 30th, 2015.

Posters Approved:

Cassius Marcellus do Carmo Figueiredo (INFNET)

Determinants of Central Bank of Brazil Intervention on Exchange Rate Market:An Empirical Approach Using Logistic Regression and Artificial Neural Networks

Claudio Cardoso Flores (IMPA)

Robust Multivariate Estimates of Location and Scatter Applied to the Optimum Portfolio Selection Problem

Francesca Munia Machado (IMPA)

Empirical Evaluation of the Black-Litterman Model

Gabriela Krull (IMPA)

Asset Liability Management Applied to a Traditional Open Annuity Plan

Gang Liu (École Polytechnique)

Rare Event Simulation Related To Financial Risks

Helder Alan Rojas Molina (IME – USP)

Simple Models of Strings of Characters with Infinite Alphabet with Applications to Order Book Dynamics

Leandro Dognini (IMPA)

Applying Analytic Bounds for Multi-Period Risk Management

Melba Luz Torres Ortiz (IME – USP)

Long-Term behavior of a stochastic model for order book dynamics

Rodrigo Maranhão (IMPA)

Ex-Dividend Day Anomaly in a Different Asset Class – The Case for Brazilian Real State Funds

Sergio Maffra (IMPA)

A Comparison of Go-Garch Estimation Methods

Visa Information

The Brazilian visa system operates under a strict reciprocity policy. That means that all citizens from Canada, the United States and other countries which require visas from Brazilians will have to obtain visas to attend the conference.

Foreign participants should get in touch with the nearest Brazilian Consulate (click on the map) to find out whether a visa is required. The list of nationalities that are exempt from this requirement, see also the official Ministry of Tourism page, includes the whole of the European Union and Mercosur. Those who do need visa should note that a tourist visa suffices for the conference; for more information about Brazil, visit the official Brazilian Institute of Tourism website.

Proceedings and abstracts – Call for papers

We will have a peer reviewed volume of contributions accompanying the conference on research topics related to those of the conference.Guideline for contributions: Standard AMS proceedings LaTeX style of up to 10 pages. Guideline for the abstracts: Standard AMS proceedings LaTeX style of up to 1 page. Submissions should be sent to math.fin.impa@gmail.com using Proceedings and Abstracts as subject. Deadline for submission of the contributions and abstracts: October 30th, 2015.

List of Registered Participants

Postal Address: Instituto Nacional de Matemática Pura e Aplicada

Estrada Dona Castorina 110, Jardim Botânico

Rio de Janeiro, RJ, CEP 22460-320, Brasil

E-mail: eventos@impa.br