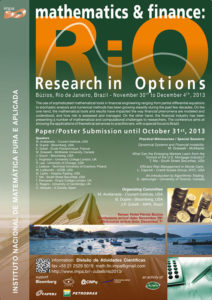

Research in Options 2013

Búzios, Rio de Janeiro, de 29/11 até 05/12, 2013

The use of sophisticated mathematical tools in financial engineering ranging from partial differential equations to stochastic analysis and numerical methods has been growing steadily during the past few decades. On the one hand, the mathematical tools and results have impacted the way financial phenomena are modeled and understood, and how risk is assessed and managed. On the other hand, the financial industry has been presenting a number of mathematical and computational challenges to researchers. The conference aims at showing the applications of theoretical advances to practitioners, with a special focus to Brazil.

This is the eitghth conference hosted by <ahref=”http:>IMPA’s group on Math Finance on the subject. It is a follow up of six highly successful previous ones. Each one had in its attendance about 100 participants evenly spread from academia and industry. This year we will focus on different aspects of option pricing ranging from fixed income and volatility trading to real options.

We will also have special sessions on risk management and portfolio optimization.

We will precede the conference with two days of minicourses. The minicourses will be aimed at practioners and students.

Accommodation

Venue: Hotel Perola Búzios

IMPORTANT: Reservations to get the group rate should be made through our travel agent (gerencia@cmoeventos.com.br) Please do make a copy to eventos@impa.br of such communications.

Arrival, Departure and Transportation

Transportation:

Transportation will be provided as follows:

Going to Hotel Pérola Búzios – From Rio de Janeiro to Búzios: BUS LIST – CLICK HERE

Friday – Nov. 29

Bus 1 – The bus will leave from IMPA (Estrada Dona Castorina, 110 – Jardim Botânico) at 2:30 p.m, on November 29. The trip takes about 3 hours.

Sunday – Dec. 1

Bus 2 – The bus will leave from IMPA (Estrada Dona Castorina, 110 – Jardim Botânico) at 3 p.m., on December 1 , Sunday.

Transportation List

Back from Búzios to Rio de Janeiro:

The bus will leave Hotel Atlantico on December 5, Thursday, by 11:00 a.m, stopping at the International Airport, and then going to IMPA.

Other options for transportation to Buzios: click Here

Certificates

Contributed Communications

Flavio Abdenur (Grupo Equant)

A practical example of entropy as a measure of portfolio diversification

Vinicius Viana Luiz Albani (IMPA)

Local Volatility Calibration in Commodity Markets

José Afonso Faias (Universidade Católica Portuguesa)

Optimal Option Portfolio Strategies

Sergio Franklin (PUC-Rio)

Real options´impact on mobile termination costs

Ruth Kaila (Helsinki University of Technology)

Portfolio optimization with the implied integrated variance

Andrey Krishenik (Cornell University)

Optimal Investment under funding risk

Nicola Langrené (Paris VII – Université Denis Diderot)

Pricing options under uncertain volatility:a BSDE with constrained jumps approach

Sergey Nadtochiy (University of Michigan)

Local Variance Gamma and Explicit Calibration to Option Prices

Adrien Nguyen Huu (IMPA)

Hedging expected loss on derivatives in electricity Futures markets

Johannes Rauch (Univ. of Sussex)

Discretisation-Invariant Swaps

Yuri Fahham Saporito (University of California Santa Barbara)

Functional Itô Calculus, Path-dependence and the Computation of Greeks

Max Oliveira de Souza (UFF)

Real Option Pricing with Mean-Reverting Investment and Project Value

Rafael Serrano Perdomo (Universidad del Rosario)

Equivalence between cost minimization problems for jump-diffusions and their linear programming formulation

Gyorgy Varga (Fce Consultoria, RJ)

Equity Liquidity Premium in Brazil

Lakshithe Wagalath (Iéseg School of Management, France)

Impact of large institutional investors on the dependence structure of asset returns

Kazutoshi Yamazaki (Kansai University)

Optimal dividends in the dual model under transaction costs

We will have a number of thematic sessions on topics of interest. To cite a few: Option Pricing, Portfolio Optimization, Risk Management, Real Options. These sessions will be composed of contributed communications of 30 minutes. Contributions should be sent to math.fin.impa@gmail.com using Contributed Communications as subject.

Deadline for submission of the contributions and posters: October 31st, 2013.

Event Webpage

Plenary Talks and Abstract

Luca Capriotti (Credit Suisse Group, NYC, USA)

Real Time Counterparty Credit Risk Management with Adjoint Algorithmic Differentiation (AAD).

Rafael Douady (Université Paris I – Sorbonne (Paris I)

The Whys of the LOIS: Credit Skew and Funding Spread Volatility.

Bruno Dupire (Bloomberg, USA)

Cognitive Biases in Finance and their Consequences .

Marcos Costa Santos Carreira (BM&F – Bovespa)

Stock Indices – Rebalancing, Intraday Dynamics, Liquidity .

Lane Hughston (Brunel University and University College London, UK)

Social Discounting and the Long Rate of Interest

Sebastian Jaimungal (University of Toronto)

Lévy-Itō models for Interest Rates

Roger Lee (U. Chicago, USA)

Variance Swaps on Time-Changed Markov Processes

Jacek Leskow (Technical University of Crackow, Poland)

Resampling in nonstationary time series with applications to financial risk assesment.

Mike Ludkovski (UCSB, USA)

Sequential Regression Methods for Optimal Stopping

Terence Ma (South Street Securities, USA)

Dollar Rolls on Mortgage-backed Securities

Laurent Partouche (EUREX)

HFT participation on Eurex and provide an overview of Eurex Exchange.

Teemu Pennanen (King’s College, UK)

Convex duality in stochastic optimization and mathematical finance.

Chris Rogers (Cambridge, UK)

Optimal investment in high dimensions (with Pawel Zaczkowski).

Claudia Sagastizabal (IMPA)

Efficient Solution of Problems with Probabilistic Constraints Arising in the Finance and Energy sectors .

Carlos Vázquez (A Coruña, Spain)

PDE and PIDE models for pension plans without and with early retirement option.

Minicourses (Saturday and Sunday) / Special Sessions (Monday – Wednesday)

Matheus Grasselli (McMaster University, Canada)

Dynamical Systems and Financial Instability.

Terence Ma (South Street Securities, USA)

What Can the Emerging Markets Learn from the Turmoil of the U.S. Mortgage Industry?

Luca Capriotti (Credit Suisse Group, NYC, USA)

Efficient Risk Management in Monte Carlo.

Sebastian Jaimungal (University of Toronto, Canada)

An Introduction to Algorithmic Trading.

Organizing Committee

Marco Avellaneda – Courant Institute, USA

Bruno Dupire – Bloomberg, USA

Jorge Zubelli – IMPA, Brazil

Picture of the Group

Poster Session

Osvaldo Assunção (IMPA)

Vasicek Model with Stochastic Volatility

Adriano de Cezaro (Univ. do Rio Grande)

On a Tikhonov Type Regularization Method for Local Volatility Model in American Option

Lucas Farias (IBMec)

Optimal Investment Strategies for Gold Spot Contracts using Genetic Algorithms

Ariel Levi (UFF)

Commodities, Country Risk and Exchange Rates: Case Brazil

Felipe Macias (IMPA)

Optimal Liquidation Strategies for Portfolios under Stress Conditions

Milene Andressa Mondek (PUC-Rio)

Pricing Options using the Hedged Monte Carlo Method

Luciana Schmid Blatter Moreira (IMPA)

Risk Analysis of a portfolio of commodities

David Evangelista da Silveira(IMPA)

Analysis of a Multifactor Model for Commodity Forward Curves in Energy Markets

Douglas Machado Vieira (IMPA)

Statistical analysis of bid-ask models for liquid markets

We will hold a poster session during part of the evenings so as to encourage the contribution of research and projects currently developed by students. Posters should be sent to math.fin.impa@gmail.com using Poster Session as subject. The standard adopted for posters is size A0 vertical.

Deadline for submission of posters: October 31st, 2013.

Proceedings and abstracts – Call for papers

We will have a peer reviewed volume of contributions accompanying the conference on research topics related to those of the conference.Guideline for contributions: Standard AMS proceedings LaTeX style of up to 10 pages. Guideline for the abstracts: Standard AMS proceedings LaTeX style of up to 1 page. Submissions should be sent to math.fin.impa@gmail.com using Proceedings and Abstracts as subject.

Deadline for submission of the contributions and abstracts: October 1st, 2013.

Tentative Program

Registered Participants

Student Participation

Student participation from related areas to financial engineering and applied mathematics is highly encouraged. In order to encourage student participation a special fee was arranged. In order to qualify for such fee you must be able to provide a proof of current registration on an institution of higher education (“instituição de ensino superior” IES by Capes/MEC definition or by EU definition).

Deadline for application for student support: October 31st, 2013.

Venue: Hotel Perola Buzios

Postal Address: Instituto Nacional de Matemática Pura e Aplicada

Estrada Dona Castorina 110, Jardim Botânico

Rio de Janeiro, RJ, CEP 22460-320, Brasil

E-mail: eventos@impa.br