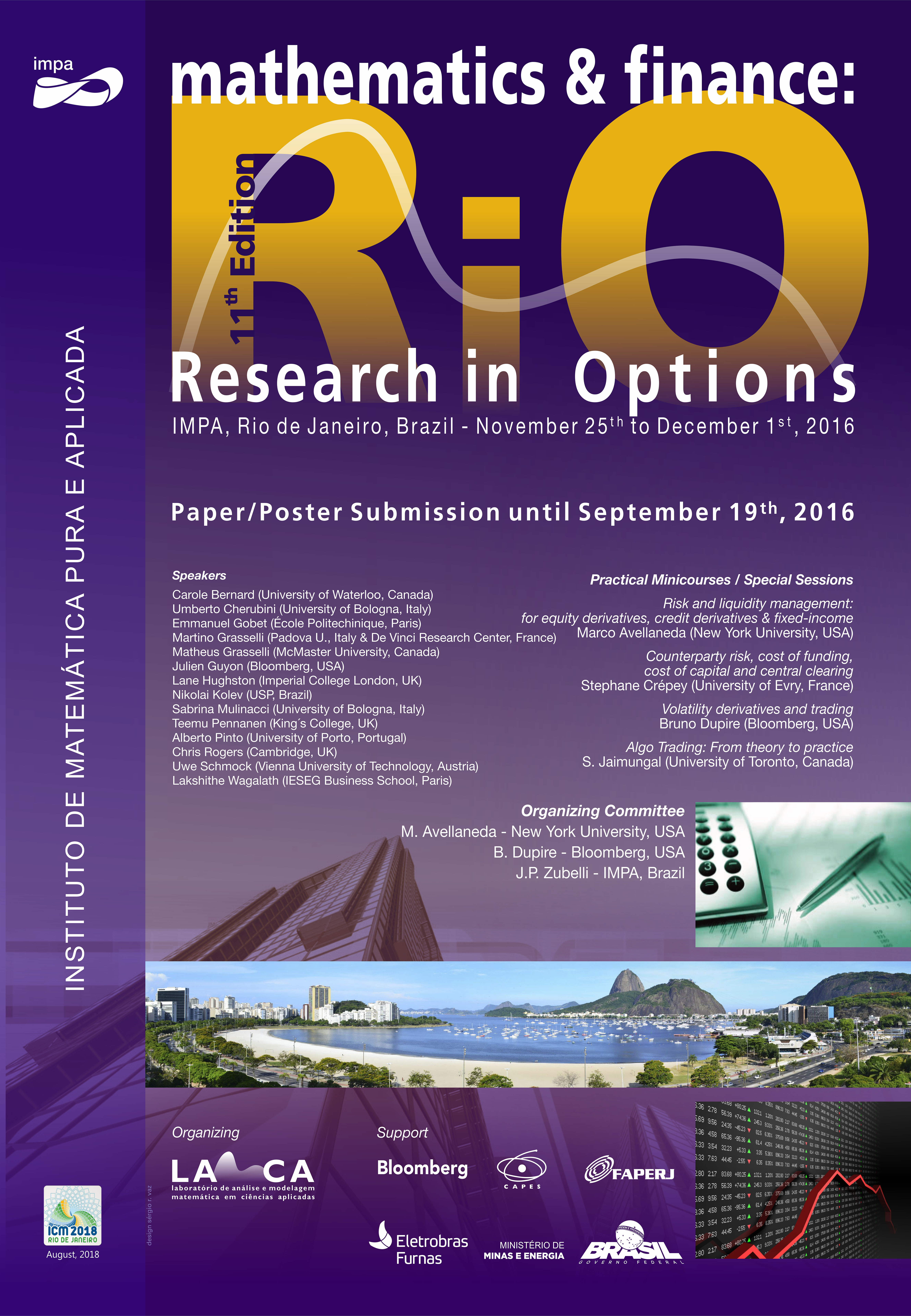

Research in Options 2016

IMPA, Rio de Janeiro, November 25th to December 1st, 2016

The use of sophisticated mathematical tools in financial engineering ranging from partial differential equations to stochastic analysis and numerical methods has been growing steadily during the past few decades. On the one hand, the mathematical tools and results have impacted the way financial phenomena are modeled and understood, and how risk is assessed and managed. On the other hand, the financial industry has been presenting a number of mathematical and computational challenges to researchers.

This is the eleventh conference hosted by IMPA’s group on Math Finance on the subject. It is a follow up of the highly successful previous editions. Each one had in its attendance about 100 participants evenly spread from academia and industry. This year we will focus on different aspects of mathematical finance including (but not limited to) option pricing, fixed income, volatility trading, real options, commodities, algorithmic trading, portfolio and risk management.

We will precede the conference with two days of minicourses. The minicourses will be aimed at both practioners and students.

Event webpage

Scientific and Local Committee

Scientific and Local Committee

Scientific Committee:

Marco Avellaneda (Courant Institute, USA)

Bruno Dupire (Bloomberg, USA)

Jorge P. Zubelli (IMPA, Brazil)

Local Committee:

Max Souza (UFF, Brazil)

Jorge P. Zubelli (IMPA, Brazil)

Certificates

Speakers, Minicourses, Short Courses and Contributed Talks

Pictures

SBMAC (Sociedade Brasileira de Matematica Aplicada e Computacional)

Este evento é parte das atividades do comitê temático de Finanças Quantitativas da Sociedade Brasileira de Matematica Aplicada e Computacional (SBMAC).

http://www.sbmac.org.br/

This event is part of the activities of the Special Interest Group on Quantitative Finance of the Brazilian Society for Applied and Computational Mathematics (SBMAC).

http://www.sbmac.org.br/

Program

Short Course Risk & Derivatives

Short Course Statistics in Finance

Minicourses / Short Courses

Minicourses:

Marco Avellaneda (New York University , USA)

Risk and liquidity management: for equity derivatives, credit derivatives & fixed-income

Stephane Crépey (University of Evry , France)

Counterparty Risk, Cost of Funding, Cost of Capital and Central Clearing

Bruno Dupire (Bloomberg)

Volatility derivatives and trading

Sebastian Jaimungal (University of Toronto, Canada)

Algo Trading: From theory to practice

Short Courses:

High Frequency Trading

Sebastian Jaimungal (Toronto, Canada)

Chris Rogers (Cambridge, UK)

Portfolio Management

Teemu Pennanen (King´s College, UK)

Stephane Crépey (U. Evry, France)

Risk & Derivatives (part I)

Bruno Dupire (Bloomberg, USA)

Marco Avellaneda (NYU, USA)

Risk & Derivatives (part II)

Raphael Douady (Riskdata, USA)

Julien Guyon (Bloomberg, USA)

Risk & Derivatives (part III)

Yuri Saporito (FGV, Brazil)

Uwe Schmock (TU Vienna)

Rodrigo Targino (FGV, Brazil)

Statistics in Finance

Nikolai Kolev (USP, Bazil)

Umberto Cherubini (U. Bologna, Italy)

Sabrina Mullinacci (U. Bologna, Italy)

Speakers

Marco Avellaneda (Courant Institute, USA)

Trading VIX Derivatives

Carole Bernard (Waterloo University, Canada)

Model-free approach to price multivariate derivatives

Umberto Cherubini (University of Bologna, Italy)

No-Arbitrage Choquet Pricing with an Application to the Irrational Exercise Problem

Stephane Crépey (U. Evry, France)

Central Clearing Valuation Adjustment

Raphael Douady (Riskdata, USA)

Bruno Dupire (Bloomberg, USA)

Special Techniques for Special Events

Emmanuel Gobet (École polytechnique, France)

MCMC design-based non-parametric regression for rare-event. Application to nested risk computations

Martino Grasselli (Univ.Padova, Italy, and De Vinci Research Center, France)

Lie Symmetry Methods for Local Volatility Models

Matheus Grasselli (McMaster University, Canada)

Macroeconomic modelling with heterogeneous agents: the master equation approach

Julien Guyon (Bloomberg)

The Particle Method for Smile Calibration

Lane Hughston (Brunel University London, UK)

Lévy-Vasicek Models and the Long-Bond Return Process

Sebastian Jaimungal (University of Toronto, Canada)

Trading algorithms with learning in latent alpha models

Nikolai Kolev (IME-USP, Brazil)

Sabrina Mulinacci (University of Bologna, Italy)

Marking to market credit derivatives on simultaneous credit events

Teemu Pennanen (King’s College, UK)

Optimal hedging and valuation of oil derivatives and refineries

Alberto A. Pinto (University of Porto)

Chris Rogers (TU Vienna, Austria)

High-frequency data: why are we looking at this?

Uwe Schmock (TU Vienna, Austria)

Multivariate Collective Risk Model: Dependent Claim Numbers and Panjer’s Recursion

Lakshithe Wagalath (IESEG, Paris, France)

Risk-based capital requirements and optimal liquidation in a stress scenario

Jorge Zubelli (IMPA)

A Non-intrusive Stratified Resampler for Regression Monte Carlo with Application to Option Pricing

Poster Session

Matheus Pimentel Rodrigues (USP – Escola Politécnica)

The effect of default risk on trading book capital requirements for public equities: an IRC application for the Brazilian Market

Rogério Medeiros (Instituto de Matemática e Estatística)

The CAPM with Social Influence

Felipe Duarte (Universidade Federal de São Paulo)

Analysis of the Methods to Calculate the Formula for a European Call Option in the Heston Model

Xu Yang (IMPA)

Calibration of the Volatility Premium in the Stochastic Volatility Mode

Fernando Aiube (Universidade do Estado do Rio de Janeiro)

Evaluating the risk premium in the U.S. natural gas market: evidence from low-price regime

Contributed Communications

Caio Almeida (FGV)

Nonparametric Option Pricing With Generalized Entropic Estimators

Gyorgy Varga (FCE Consulting)

Volatility Trading under a Mean Reverting Process

José Faias (Universidade Católica Portuguesa)

Equity Premium Predictability from Cross-Sectorial Downturns

Juan Arismendi (Universidade Nacional de Brasília)

The Implications of Tail Dependency for Counter Party Credit Risk Modelling

Juan Pablo Gama (IMPA)

Volatility on Procylical Assets with Risk Loving

Julio Backhoff Veraguas (Vienna University of Technology)

On the Dynamic Representation of Some Time-Inconsistent Risk Measures in a Brownian Filtration

Rafael Moura Azevedo (Universidade Federal de Pernambuco)

Semi-Parametric Entropic Estimation of State Price Densities Implicit in Interest Rate Derivatives

Ryan Donelly (École Polytechnique Fédérale de Lausanne)

Insider Trading with Residual Risk

Stefano De Marco (Centre de Mathématiques Appliquées – Ecole Polytechnique)

Asymptotics and calibration for American options

Youngna Choi (Montclair State University)

Tracking Financial Instability Contagion: modeling and data calibration

Ariel Levy (Universidade Federal Fluminense) e Fernando Aiube (Universidade do Estado do Rio de Janeiro)

Recent movement of crude oil prices: evidence from log-normal modeling

List of Registered Participants

Postal Address: Instituto Nacional de Matemática Pura e Aplicada

Estrada Dona Castorina 110, Jardim Botânico

Rio de Janeiro, RJ, CEP 22460-320, Brasil

E-mail: eventos@impa.br