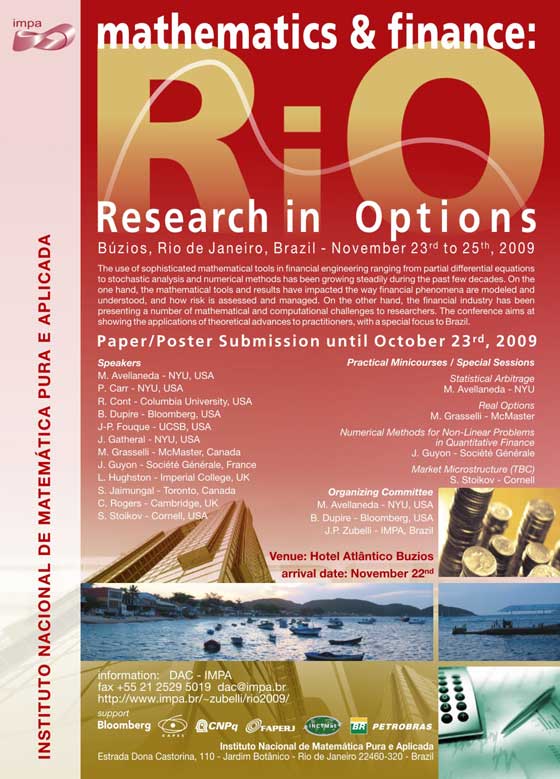

Research in Options 2009

Buzios, Rio de Janeiro, November 23 – 25, 2009

The use of sophisticated mathematical tools in financial engineering ranging from partial differential equations to stochastic analysis and numerical methods has been growing steadily during the past few decades. On the one hand, the mathematical tools and results have impacted the way financial phenomena are modeled and understood, and how risk is assessed and managed. On the other hand, the financial industry has been presenting a number of mathematical and computational challenges to researchers. The conference aims at showing the applications of theoretical advances to practitioners, with a special focus to Brazil.

Minicourses:

Julien Guyon (Société Générale) – Numerical Methods for Nonlinear Problems in Quantitative Finance

Marco Avellaneda (NYU) – Statistical Arbitrage and Systematic Trading Strategies

Matheus Grasselli (McMaster) – Real Options and Game Theory

Sasha Stoikov (Cornell) – Market Microstructure

Organizing Committee:

Estrada Dona Castorina 110, Jardim Botânico

Rio de Janeiro, RJ, CEP 22460-320, Brasil

E-mail: eventos@impa.br