16th SAET Conference on Current Trends in Economics

IMPA, Rio de Janeiro, July 6 – 9, 2016

The 16th Annual SAET Conference will be held July 6-9, 2016 at the Institute for Pure and Applied Mathematics, IMPA, Rio de Janeiro, RJ, Brazil.

The conference chairs are José Heleno Faro, Juan Pablo Gama Torres, Susan Schommer and Nicholas Yannelis.

Please direct any general questions to saet2016@impa.br.

Confirmed Participants

Among many others, we have the following confirmed participants. For a complete list of Session Organizers.

Nancy Stokey (University of Chicago)

The Race Between Technology and Human Capital

Felix Kubler (University of Zürich)

Robert E. Lucas, JR (University of Chicago) – Nobel Laureate

Victor Filipe Martins-da-Rocha (FGV-EESP)

Andreu Mas-Colell ( Universitat Pompeu Fabra)

Mario Pascoa (University of Surrey)

Daniela Puzzello (Indiana University)

John Quah (University of Oxford)

Alvaro Sandroni (Kellogg)

Chris Shannon (University of California-Berkeley)

Nancy Stokey (University of Chicago)

Rabee Tourky (Australian National University)

Robert M. Townsend (MIT Economics)

Walter Trockel (Bielefeld University)

Anne Villamil (University of Iowa)

Xavier Vives (IESE Business School)

Myrna Wooders (Vanderbilt University)

Michael Woodford (Columbia University)

Nicholas Yannelis (University of Iowa)

Beth Allen (University of Minnesota)

Nizar Allouch (Queen Mary, University of London)

Yves Balasko (University of York)

Svetlana Boyarchenko (University of Texas-Austin)

Simone Cerreia-Vioglio (Università Bocconi)

Alain Chateauneuf (PSE-University of Paris I)

Youngsub Chun (Seoul National University)

Bernard Cornet (PSE-University of Paris I & University of Kansas)

Juan Dubra (Universidad de Montevideo)

Ana Fostel (University of Virginia)

John Geanakoplos (Yale University)

Piero Gottardi (European University Institute)

Roger Guesnerie (Collège de France)

Carlos Hervés-Beloso (University of Vigo)

Hugo Hopenhayn (University of California)

Johannes Horner (Yale University)

Timothy Kehoe (Univ. of Minnesota & Federal Reserve Bank of Minneapolis)

M. Ali Khan (Johns Hopkins University)

Dan Kovenock (Chapman University)

Tom Krebs (University of Mannheim)

Organizing and Scientific Committee

Aloisio Araujo – IMPA

Jose Heleno Faro – INSPER

Susan Schommer – UERJ

Nicholas Yannelis – University of Iowa

Juan Pablo Gama Torres – IMPA

Executive and Program Committee

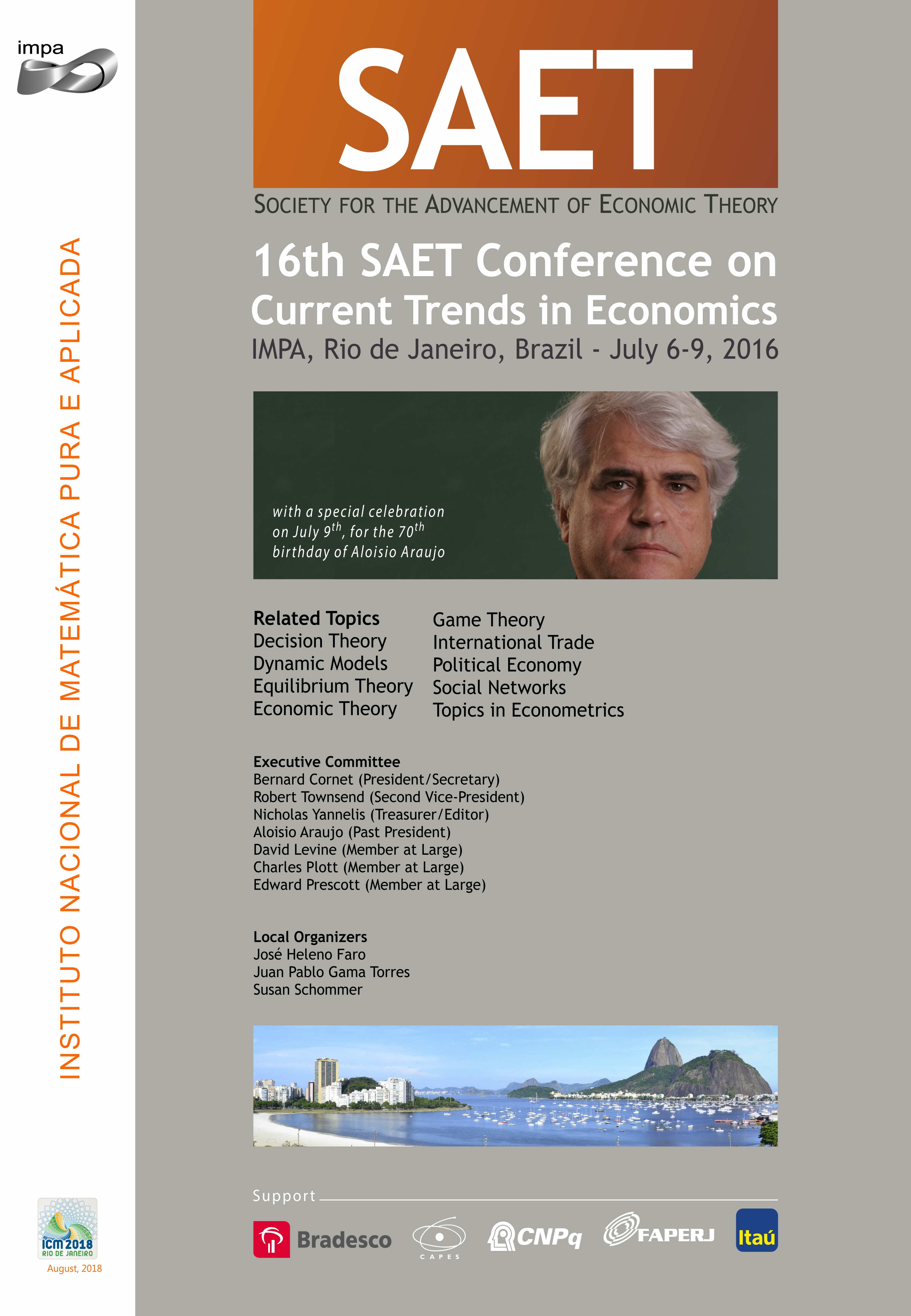

Executive Committee:

Bernard Cornet (President/Secretary)

Robert Townsend (Second Vice-President)

Nicholas Yannelis (Treasurer/Editor)

Aloisio Araujo (Past President)

David Levine (Member at Large)

Charles Plott (Member at Large)

Edward Prescott (Member at Large)

Program Committee:

Beth Allen (University of Minnesota, USA)

Nizar Allouch (Queen Mary, University of London, UK)

Costas Arkolakis (Yale University, USA)

Yves Balasko (University of York, UK)

Bernard Cornet (PSE-University of Paris I & University of Kansas, France & USA)

Roger Guesnerie (Collège de France, France)

Hugo Hopenhayn (University of California, USA)

Johannes Horner (Yale University, USA)

Timothy Kehoe (Univ. of Minnesota / Federal Reserve Bank of Minneapolis, USA)

Fuhito Kojima (Stanford University, USA)

Dan Kovenock (Chapman University, USA)

David Levine (Washington University-St. Louis, USA)

Edward Prescott (Federal Reserve Bank-Richmond, USA)

Philip Reny (University of Chicago, USA)

Alvaro Sandroni (Kellogg, USA)

Chris Shannon (University of California-Berkeley, USA)

Anne Villamil (University of Iowa, USA)

Videos of the Talks

Session Details

Aggregation and Welfare:

Carolina Manzano (Universitat Rovira I Virgili Tarragona) – Session Organizer

– Erik Eyster (London School of Economics) (with Matthew Rabin & Dimitri Vayanos)

Financial Markets where Traders Neglect the Informational Content of Prices

– Vladimir Asriyan (Stanford) (with William Fuchs & Brett Green)

Information Spillovers in Asset Markets with Correlated Values

– Tibor Heumann (Yale University)

Trading with Multidimensional Signals

– Carolina Manzano (Universitat Rovira I Virgili Tarragona) (with Xavier Vives, Universidad de los Andes)

Market Power and Welfare in Asymmetric Divisible Good Auctions

Applied Economics:

Alvaro Riascos (Universidad de los Andes) – Session Organizer

– Ricardo Paes de Barros (Insper)

Challenges for an inclusive educational development

– Renato Soeiro (University of Porto)

The Formation of Societies with Linear Utilities

– Alvaro Riascos (Universidad de los Andes)

A Structural Model to Evaluate the Transition from Self‐Commitment to Centralized Unit Commitment

Asset bubbles and Economic Growth:

Cuong Le Van (University of Paris I) – Session Organizer

– Ngoc-Sang Pham (University of Lille 3) (with Cuong Le Van, University of Paris I)

Assets with negative dividends

– Thai Ha-Huy (UERJ) (with Cuong Le Van, University of Paris I)

No arbitrage condition and asset market equilibrium in exchange economies with risk-averse utilities and a continuum number of states

– Matthieu Boullot (University of Newcastle)

Secular Stagnation, Liquidity Trap and Rational Asset Price Bubbles

– Thomas Seegmuller (AMSE – CNRS) (with Xavier Raurich, University of Barcelona)

Growth, productive bubbles and population dynamics

Central Bank Session in honor of Aloisio Araujo: Theoretical and empirical assessments to assist the CB decisions:

Rafael Chaves Santos (Banco Central do Brasil) – Session Organizer

– Jose Valentim Machado Vicente (BCB) (with Gustavo Silva Araujo, BCB)

What does the tail of the distribution of current stock prices tell us about future economic activity?

– Rafael Santos (BCB) (with Aloisio Araujo, IMPA & Tiago Berriel, PUC-Rio)

Inflation Targeting with Imperfect Information

– Ricardo Schechtman (with Tony Takeda, BCB)

Are capital (and earnings) incentives effective for loans loss provisions?

– Marta Areosa (BCB) (with Waldyr Areosa, BCB & Vinicius Carrasco, PUC-Rio)

Optimal Informational Interest Rate Rule

Coalition and Network Formation:

Armando Gomes (Olin School of Business, Washington University in St. Louis, USA) – Session Organizer

– Joao Ramos (USC – Marshall School of Business) (with Bernand Herskovic)

Acquiring Information Through Peers

– Francis Bloch (Ecole Polytechnique, France) (with Anne van den Nouweland)

Farsighted coalition formation when players have different expectations

– Armando Gomes (Olin School of Business, Washington University in St. Louis, USA)

Coalitional Bargaining Games: A New Concept of Value and Coalition Formation

Contests and Applications:

Dan Kovenock (Chapman University, USA) – Session Organizer

– Alan Gelder (Chapman University) (with Dan Kovenock, Chapman University & Brian Roberson, Purdue University)

Experiments on Generalized Colonel Blotto Games

– Sergio O. Parreiras (University of North Carolina) (with Fei Li, University of North Carolina)

Asymmetric All-Pay Auctions

– Alberto Vesperoni (University of Siegen) (with Irem Bozbay, University of Surrey)

A contest success function for networks

– Dan Kovenock (Chapman University, USA) (with Brian Roberson, Purdue University)

The N-Player Colonel Blotto Game

Contests I:

Dan Kovenock (Chapman University, USA) – Session Organizer

– Blake A. Allison (Emory University) (with Jason J. Lepore, Cal Poly-San Luis Obispo)

Contests with Interdependent Valuations

– Christian Ewerhart (University of Zurich)

Computing Equilibria in All-Pay Contests

– Philipp Denter (Universidad Carlos III de Madrid) (with John Morgan, University of California & Dana Sisak, Erasmus University Rotterdam)

Showing Off

– Kai A. Konrad (Max Planck Inst. for Tax Law and Public Finance) (with Samuel Haefner, University of Basel)

Eternal Peace in the Tug-of-War

Contests II:

Dan Kovenock (Chapman University, USA) – Session Organizer

– Jun Xiao (University of Melbourne)

Whether to Hire a Superstar?

– Cedric Wasser (University of Bonn) (with Andreas Kleiner, University of Bonn)

Contest Design when Only the Highest Effort Matters

– Lucas Rentschler (Universidad Francisco Marroquin) (with Theodore L. Turocy, University of East Anglia)

Tu mihi soli places: An experiment on the competitiveness of all-pay auctions with private information

– Dan Kovenock (Chapman University, USA)(with Subhasish M. Chowdhury, University of East Anglia; David Rojo Arjona, University of Leicester & Nat Wilcox, Chapman University)

Focality and Asymmetry in Multi-Battle Contests

Coordination Games:

Jack Stecher (Carnegie Mellon University) – Session Organizer

– Camilo Botia (Carnegie Mellon University)

Ban Runs and Risk-Shifting in the Presence of Information Disclosure Lags

– Jack Stecher (Carnegie Mellon University)

Do Mandatory Liquidity Disclosures Foster or Forestall Coordination Failures?

– Andrei Gomberg (ITAM) , Diego Aycinena (Universidad Francisco Marroquín), Alexander Elbittar (CIDE) & Lucas Rentschler (Universidad Francisco Marroquín)

When Should the Jurors Talk?

Decision Theory:

Jack Stecher (Carnegie Mellon University) – Session Organizer

– In-Koo Cho ( University of Illinois) & Anna Rubinchik (University of Haifa)

Contemplation vs. Intuition. A Reinforcement Learning Perspective

– Patricia Rich (University of Bristol)

Coherence and Correspondence Decision Criteria: How to Evaluate Processes

– Tommaso Denti (Massachusetts Institute of Technology)

Endogenous Information Smallness

– Elif Incekara-Hafalir (Carnegie Mellon University) & Jack Stecher (Carnegie Mellon University)

A Zero Effect Explains Deviations from Expected Utility in Allais-type Tasks

Decision under Uncertainty:

Simone Cerreia-Vioglio (Università Bocconi, Italy) – Session Organizer

– Andrew Ellis (LSE)

On Dynamic Consistency in Ambiguous Games

– Jay Lu (UCLA)

A Bayesian Theory of State-Dependent Utilities

– Simone Cerreia-Vioglio (Università Bocconi, Italy) (with F. Maccheroni and M. Marinacci)

Absolute Uncertainty Aversion: A Preferential Approach

Default, Bankruptcy and Collateral:

Mauricio Villalba (IMPA) – Session Organizer

– Mauricio Villalba (IMPA)

Bankruptcy Equilibrium: Efficiency and contagion

– Susan Schommer (IMPA) (with Aloisio Araujo & Michael Woodford)

Conventional and Unconventional Monetary Policy with Endogenous Collateral Constraints and Labor-Market Frictions

– Liev Ferreira Maribondo (IMPA)

Prudential Regulation in a General Equilibrium Model

– V. Filipe Martins-da-Rocha (FGV – EESP) (with Yiannis Vailakis, U. of Glasgow)

Characterization of self-enforcing debt under the risk of default

Debt and Default: Fluctuations and Trends:

Igor Livshits (University of Western Ontario, Canada) – Session Organizer

– Igor Livshits (University of Western Ontario, Canada) (with D. Fieldhouse & J. MacGee)

Aggregate Fluctuation, Consumer Credit and Bankruptcy

– Jacob Short (University of Western Ontario) (with with A. Glover)

Bankruptcy, Incorporation and the Nature of Entrepreneurial Risk

– Kyle Herkenhoff (University of Minnesota)

The Impact of Consumer Credit Access on Employment, Earnings and Entrepreneurship

Development/Environment Dynamics and Unemployment:

Takashi Kamihigashi (Kobe University) – Session Organizer

– Evangelos V. Dioikitopoulos (King’s College London) with Ken Tabata (Kwansei Gakuin University)

The Elimination of Common Rights and Comparative Economic Development in a Malthusian World

– Adriana Piazza (Adolfo Ibáñez University) with Santanu Roy (Southern Methodist University)

Irreversibility in deforestation and optimal forest conservation

– Takashi Kamihigashi (Kobe University) with Cagri Saglam (Bilent University) & Hamide Turan (Bilkent University)

Optimal cycles in the Dechert-Nishimura model with time to build

– Katsufumi Fukuda (Hiroshima University) with Takashi Kamihigashi (Kobe University)

Immigration and unemployment

Dynamic Games:

Johannes Horner (Yale University, USA) – Session Organizer

– Joyee Deb (Yale SOM)

Reputation Building under Uncertain Monitoring

– Helios Herrera (Warwick)

The Marginal Voter’s Curse

– Oscar Volij (Ben Gurion – Israel) with Casilda Lasso de la Vega (University of the Basque Country)

The Value of a Draw in Quasi-Binary Matches

– Anna Sanktjohanser (Oxford)

Endogenous Monitoring in a Partnership Game

Dynamic games with incomplete information:

Richard P. McLean (Rutgers University) – Session Organizer

– Aniko Oery (Yale SOM) (with Yuhta Ishii, ITAM & Adrien Vigier, Oxford)

Hiring Trainees: Bargaining with Learning and Competition

– Dongkyu Chang (City University of Hong Kong – Department of Economics and Finance)

Delay in Bargaining with Outside Options

– Braz Ministerio de Camargo (São Paulo School of Economics – FGV)

Efficiency in Decentralized Markets with Aggregate Uncertainty

– Richard P. McLean (Rutgers University) (with A. Postlewaite)

A Dynamic Non-direct Implementation Mechanism for Interdependent Value Problems

Dynamic Programming:

Juan Pablo Rincón-Zapatero (Universidad Carlos III de Madrid, Spain) – Session Organizer

– Martin Dumav (Universidad Carlos III de Madrid)

Continuous-time contracting with ambiguous perceptions

– Kenji Sato (Graduate School of Economics, Kobe University) (with V. Filipe Martins-da-Rocha, Sao Paulo School of Economics–FGV & Yiannis Vailakis, University of Glasgow)

Differentiability of the policy function in models with equilibrium growth

–Juan Pablo Rincón-Zapatero (Universidad Carlos III de Madrid, Spain)

Stability of the policy function in recursive utility models

Econometric Methods:

Sergio Pinheiro Firpo (Insper, Brazil) – Session Organizer

– Klenio Barbosa (EESP-FGV)

Discrimination in Dynamic Procurement Design with Learning-by-doing

-Alessandro Casalecchi (EESP-FGV)

Testing for Selection on Unobservables in Fuzzy Regression Discontinuity Designs

-Tong Li (Vanderbilt University)

A Partial Identification Subnetwork Approach to Discrete Games in Large Networks: An Application to Quantifying Peer Effects

– Art Shneyerov (Concordia University)

Inference for First-Price Auctions with Guerre, Perrigne, and Vuong’s estimator

Economic Dynamics:

Wilfredo Maldonado (Universidade Católica de Brasília) & Alberto Pinto (Universidade do Porto) – Session Organizers

– Alberto Pinto (Universidade do Porto) (with João P. Almeida & Telmo Parreira)

Hotelling Model in a Network with Uncertainty in Costs of Production

– Elvio Accinelli (Universidad Autónoma de San Luis Potosí) (with Enrique Covarrubias)

Evolution and jump in a Walrasian framework

– Andrei Barbos (University of South Florida)

Dynamic Contracts with Random Monitoring

– Filipe Martins ( Universidade de Porto)

Impact of Nash and Social Equilibria in an International Trade Model

Economic Theory:

Nicholas Yannelis (University of Iowa) – Session Organizer

– Myrna Wodders (Vanderbilt University) (with P. Chander)

The Subgame Perfect Core

– Konrad Podczeck (University of Vienna) (with Michael Greinecker, University of Innsbruck)

Core equivalence with differentiated commodities

– Patrick Beissner (Australian National University)

A Theory of Value for Information

– Andrew Clausen (University of Edinburgh)

Extreme Incentives

Economic Theory II:

Jean-Marc Bonnisseau (Université Paris 1) – Session Organizer

– Jan Wenzelburger (University of Liverpool) (with Georg Hamanyan)

On the Reduction of Default Risk of Financial Intermediaries

– M. Ali Khan (Johns Hopkins University) (with Yongchao Zhang)

On Sufficiently-Diffused Information in Bayesian Games: A Dialectical Formalization

– Jean-Marc Bonnisseau (Université Paris 1) (with Senda Ounaies & Souhail Chebbi)

Equilibrium of a production economy with unbounded attainable allocations set

Economic Theory & Applications:

Luis Braido (FGV) – Session Organizer

– Paulo K. Monteiro (FGV)

Brazilian Pre-sal Auction

– Carlos da Costa (FGV)

Taxation of couples: Optimal Mechanism for Collective Households (with Lucas de Lima)

– Carlos Hervés-Beloso (University of Vigo, Spain) (with Emma Moreno García, Universidad de Salamanca)

General equilibrium with externalities; revisiting the Coase theorem

– Luis Braido (FGV)

Dynamic Price Competition in Auto-insurance Brokerage (with Bruno Ledo)

Economics of learning and information:

Tai-Wei Hu (Northwestern University, USA) – Session Organizer

– Rabee Tourky (Australian National University)

A theory of robust experiments for choice under uncertainty

– Sander Heinsalu (University of Queensland)

PageRank vs Bayes´ rule

– Henrique de Oliveira (Princeton University)

Blackwell´s inforativeness theorem using category theory

– Tai-Wei Hu (Northwestern University, USA)

Self-confirming equilibrium with bounded memories

Expectations and learning:

Roger Guesnerie (Collège de France and Paris School of Economics) – Session Organizer

– Alexandra Belova (Université Paris 1) (with Philippe Gagnepain & Stéphane Gauthier, Paris School of Economics)

Eductive Stability in the Airline Industry: Theory and Structural Estimation

– Elliott Aurissergues (Université Paris 1)

The limits of learning

– Wilfredo Maldonado (Universidade Católica de Brasília) (with Aloisio Araujo, Mohamad Choubdar, Diogo Pinheiro & Alberto Pinto)

Refinement of Dynamic Equilibrium using Small Random Perturbations

– Roger Guesnerie (Collège de France and Paris School of Economics)

Expectational coordination in macroeconomics, the “eductive” viewpoint, an overview

Finance and decision:

Alain Chateauneuf (PSE-Université de Paris I, France) & Bernard Cornet (PSE-University of Paris I & University of Kansas, France & USA) – Session Organizers

– Xiangyu QU (Université de Paris II)

Uncertainty Averse Mean Variance Utility

– Alain Chateauneuf (PSE-University of Paris I, France) (with Paulo Casaca and Jose Heleno Faro)

Inframodular Majorization and Multidimensional Inequalities

– Bernard Cornet (PSE-University of Paris I & University of Kansas, France & USA) (with Alain Chateauneuf)

On Choquet pricing for financial markets with frictions

– Philippe Bich (Université de Paris I)

Strategic uncertainty: a new refinement of the Nash equilibrium concept in discontinuous games

Financial and monetary equilibria contributions by former IMPA students:

Mario Pascoa (University of Surrey) – Session Organizer

– Rodrigo Novinski (IBMEC)

Endogenous Discounting, Wariness and Efficient Capital Taxation (with Aloisio Araujo, Juan Pablo Gama and Mario Pascoa)

– Juan Pablo Gama (IMPA) (with Aloisio Araujo & Mario Pascoa)

Crashing of efficient stochastic bubbles with long-lived agents

– Jaime Orrillo (U. Catolica de Brasilia) (with Miguel León-Ledesma)

Production and Endogenous Bankruptcy under Collateral Constraints

Firm Dynamics and the Macroeconomy:

Timothy J. Kehoe (Univ. of Minnesota / Federal Reserve Bank of Minneapolis, USA) – Session Organizer

– Jack Rossbach (University at Albany-SUNY) (with Manuel Garcia-Santana, Universitat Pompeu Fabra & Jose Asturias, Georgetown University School of Foreign Service)

Productivity dispersion and misallocation with multiple production technologies

– David Pérez Reyna (Universidad de los Andes) (with Fernando Perez Cervantes, Banco de México & Bernabe Lopez-Martin, Banco de México)

The full weight of the law: The impact of contract enforcement on firm dynamics and development

– Pedro Bento (Texas A&M University)

Competition, innovation, and the number of firms

– Timothy J. Kehoe (Univ. of Minnesota / Federal Reserve Bank of Minneapolis, USA) (with Jose Asturias, Georgetown University School of Foreign Service; Sewon Hur, University of Pittsburgh & Kim J. Ruhl, Pennsylvania State University)

Firm entry and exit and aggregate growth

Games and Decision:

Beth Allen (University of Minnesota, USA) – Session Organizer

– Pierre Chiappori (Columbia University)

Multidimensional Matching (with Robert McCann and Brendan Pass)

– Leandro Gorno (FGV/EPGE)

Revealed preference and identification

– Juan Dubra (Universidad de Montevideo)

A Theory of Rational Attitude Polarization

General Equilibrium:

Yves Balasko (University of York, UK) – Session Organizer

– Yves Balasko (University of York, UK)

Sunspot equilibria with general demand functions

– Rafael Rossi Silveira (University of York)

Auction Theory meets General Equilibrium Effects Solving a Vickrey Auction Embedded in an Exchange Economy

– Octavio Tourinho (UERJ)

Factor proportionality in multiple households closed CGE models: Further evidence

– Mich Tvede (Newcastle University)

Ambiguity and voting

Government, Institutions and Public Policy:

Cecilia Testa (University of Nottingham) – Session Organizer

– Jiahua Che (Fudan) (with Masahiko Aoki & Masaki Nakabayashi, Tokyo University)

A Three-Party Game of Institutional Resilience versus Transition: A Model and Comparative History of China-Japan Revisited

– Bernardo Guimarães (São Paulo School of Economics, FGV) (with Kevin D., London School of Economics)

Political Specialization

– Cecilia Testa (University of Nottingham) (with Giovanni Facchini, University of Nottingham)

The rhetoric of closed borders: quotas, lax enforcement and illegal migration

Household Behavior and the Macroeconomy:

Timothy J. Kehoe (Univ. of Minnesota / Federal Reserve Bank of Minneapolis, USA) – Session Organizer

– S. Nuray Akin (Özyeğin University)

The Chinese household saving rate

– Richard Condor (University of Minnesota)

Housing, business cycles, and macroprudential policies

– Ana Luisa Pessoa de Araujo (University of Minnesota)

Wage inequality and job stability

Industrial Organization

Steffen Lippert (University of Auckland, New Zealand) – Session Organizer

– Guillem Roig (Universidad del Rosario, Bogota) (with Nisvan Erkal, University of Melbourne)

Research Paths, Strategic Disclosure and Exit

– Rogerio Mazali (Catholic University of Brasília) (with Jose A. Rodrigues-Neto, Australian National University, Canberra)

Social Status, Reputation, Financing and Commitment

– Jose A. Rodrigues-Neto (Australian National University, Canberra) (with Rogerio Mazali, Catholic University of Brasília)

Franchising

– Sherif Nasser (Cornell University) (with Danko Turcic, Washington University in St. Louis)

Temporary Price Discount to a Retailer with a Private Demand Forecast

Information and Decisions:

José Alvaro Rodrigues-Neto (Australian National University) – Session Organizer

– Simona Fabrizi (University of Auckland) (with Addison Pan, Massey University)

A Generalisation of Feddersen and Pesendorfer (1998): Voting Under Ambiguity

– James Taylor (Australian National University) (with Jose A. Rodrigues-Neto, Australian National University)

Common Knowledge for Behavioral and Rational Agents

– Ruitian Lang (Australian National University)

Try before you buy: optimal pricing with continuous information collection

– Nejat Anbarci (Deakin University) (with Saptarshi P. Ghosh, Shiv Nadar University & Jaideep Roy, Deakin University)

Horses for Courses: controlling information to elicit talent

International Capital Flows:

Timothy J. Kehoe (Univ. of Minnesota / Federal Reserve Bank of Minneapolis, USA) – Session Organizer

– Laura Sunder-Plassmann (University of Copenhagen) (with David Wiczer, Federal Reserve Bank of St. Louis)

Reschedule, write-off, delay: The various dimensions of sovereign debt restructuring

– João Ayres (University of Minnesota)

Knowledge flow and international recessions

– Maria Jose Rodriguez Garcia (University of Minnesota)

Investment for the demographic window in Latin America

– Timothy L. Uy (University of Cambridge) (with Giancarlo Corsetti, University of Cambridge & Aitor Erce, European Stability Mechanism)

Debt sustainability with IMF vs. EFSF-ESM bailout packages

International Trade:

Giovanni Facchini (University of Nottingham, UK) – Session Organizer

– Emanuel Ornelas (Sao Paulo School of Economics, FGV, Brazil)

Preferential Trade Agreements and Global Sourcing

– Eric Bond (Vanderbilt University, USA)

Safeguards

– Peri A. Silva (Kansas State University, USA) (with Marcelo Olarreaga, University of Geneva, Switzerland & Alessandro Nicita, UNCTAD, Switzerland)

Cooperation in WTO’s Tariff Waters

– Giovanni Facchini (University of Nottingham, UK) (with Peri A. Silva, Kansas State University, USA & Gerald Willmann, University of Bielefeld, Germany)

The Political Economy of Preferential Trade Arrangements: An Empirical Investigation

International Trade:

Timothy J. Kehoe (Univ. of Minnesota / Federal Reserve Bank of Minneapolis, USA) – Session Organizer

– Illenin Kondo (Federal Reserve Board)

Trade liberalization, income risk, and optimal taxation

– Daniela Costa (University of Minnesota)

Primary commodity exports and terms of trade shocks

– Andrea Waddle (University of Richmond)

Trade, technological change, and wage inequality: The case of Mexico

Macroeconomics:

Pablo Andrés Neumeyer (Universidad Torcuato Di Tella) – Session Organizer

– Felipe S. Iachan (FGV/EPGE) (with Plamen Nenov & Alp Simsek)

The Choice Channel of Financial Innovation

– Pablo Andrés Neumeyer (Universidad Torcuato Di Tella)

From Hyperinflation to Stable Prices: Argentina’s evidence on menu cost models (with Fernando Alvarez, Martin Beraja and Martin Gonzalez Rozada)

Macro Perspectives:

Kyle Herkenhoff (University of Minnesota, USA) – Session Organizer

– Leland Crane (Board of Governors of the Federal Reserve System)

Sorting, Firm Size, and Search

– Pedro Silos (Temple University) (with German Cubas, University of Houston)

Progressive Taxation and Risky Career Choices

– Joao Ramos (New York University) (with Bernard Herskovic, University of California)

Promoting Educational Opportunities: long-run implications of affirmative action in college admissions

Matching markets and Insurance:

Eduardo Azevedo (Wharton School, USA) & Andrés Carvajal (EPGE-FGV, Brazil) – Session Organizers

– Braz Camargo (EESP-FGV) (with Paula Onuchic)

The Risk-Incentive Trade-off in Competitive Search

– Joao Thereze-Ferreira (EPGE-FGV) (with Andres Carvajal)

Insurance Contracts and Financial Markets

– Cecilia Machado (EPGE-FGV) with Christiane Szerman

The Effects of a Centralized College Admission Mechanism on Migration and College Enrollment: Evidence from Brazil

– Daniel Monte (EESP-FGV)

Dynamic Matching Markets and the Deferred Acceptance Mechanism

Monetary Economics:

Daniela Puzzello (Indiana University, USA) – Session Organizer

– Luis Araujo (Fundacao Getulio Vargas, Sao Paulo)

Credit Relationships in a Monetary Economy

– Fabrizio Mattesini (Universitá di Roma, Tor Vergata)

Money and Collateral

– Vincent Bignon (Banque de France)

Monetary Union with a Single Currency and Imperfect Credit Market Integrations

– Régis Breton (Banque de France)

Monetary Policy Before Central Banking: Willingness to Pay Seigniorage, the Quality of Money and the Debasement Puzzle

Monotone Methods:

Tarun Sabarwal (University of Kansas, USA) – Session Organizer

– Eric Hoffmann (West Texas A&M University)

Global Games Selection in Games with Strategic Substitutes or Complements

– Anders Laugesen (Aarhus University)

Monotone Comparative Statics for the Industry Composition

– Tarun Sabarwal (University of Kansas, USA)

Directional Monotone Comparative Statics

Multiple Priors Models:

José Heleno Faro (Insper) – Session Organizer

– Pietro da Silva (UFS)

Survival and Uncertainty through Variational Preferences

– Pietro Dindo (Scuola Superiore Sant’Anna, Pisa)

Survival in Speculative Markets

– Bruno Holanda (UFG) (with Aloisio Araujo, IMPA & EPGE/FGV; Alain Chateauneuf, Univ. Paris 1 & Ipag; José Heleno Faro, Insper)

Dynamical Market Structures

– José Heleno Faro (Insper) (with Jean Philippe Lefort, U. Paris-Dauphine)

Dynamic Objective and Subjective Rationality

Nash program and implementation:

Walter Trockel (Universität Bielefeld) – Session Organizer

– Yuan Ju (University of York) (with Jiawen Li, University of York)

Devide and Choose: A non-cooperative approach to the Talmud solution for bankruptcy problems

– Walter Trockel (Universität Bielefeld) (with Papatya Duman, Istanbul Bilgi University)

On Non-Cooperative Foundation and Implementation of the Nash Solution in Subgame Perfect Equilibrium via Rubinstein´s Game

– Nora Wegner (Bank of England) (with Peter Eccles, Universidad Carlos III de Madrid)

Generalised Weighted Raiffa Solutions

Networks:

Francis Bloch (Ecole Polytechnique, France) – Session Organizer

– Sebastian Bervoets (Aix-Marseille School of Economics)

Best-response dynamics in network games with substitutes

– Francis Bloch (Université Paris 1) (with Bhaskar Dutta, University of Warwick; Stephane Robin, French National Centre for Scientific Research & Min Zhou, Huazhong University of Science and Technology Wuhan)

The formation of partnerships in social networks

– Vladimir Matveenko (St.Petersburg School of Economics and Management) (with Alexei Korolev, National Research University Higher School of Economics & Anastasia Alfimova, National Research University Higher School of Economics)

On dynamic stability of equilibrium in network game with production and externalities

– Luca Paolo Merlino (Universitè Paris 1) (with Nicole Tabasso, University of Surrey)

Debunking rumors in networks

New Methods for Dynamic Economies I:

Kevin Reffett (Arizona State University, USA) & Łukasz Woźny (Warsaw School of Economics, Poland) – Session Organizers

– John Stachurski (Australian National University) (with Jaroslav Boravicka, New York University & Thomas Sargent, New York University)

Dynamic Forward Looking Equilibria: An Operator-Theoretic Approach

– Serguei Maliar (Santa Clara University) (with Lilia Maliar, Standford University; John B. Taylor, Stanford University – NBER & Inna Tsener, University of Alicante)

A Tractable Framework for Analyzing a Class of Nonstationary Markov Models

– Rodrigo Raad (Federal University of Minas Gerais)

Approximate Lipschitz Recursive Equilibrium with a Minimal State Space in the Ramsey Model

– Kevin Reffett (Arizona State University) (with Manjira Datta, Arizona State University & Łukasz Woźny, Warsaw School of Economics).

Minimal State Space Recursive Equilibrium in Economies with No-Income Preferences and Indeterminacy

New Methods for Dynamic Economies II:

Kevin Reffett (Arizona State University, USA) & Łukasz Woźny (Warsaw School of Economics, Poland) – Session Organizers

– Jean-Pierre Drugeon (Paris School of Economics) (with Bertrand Wigniolle, Paris School of Economics / University of Paris 1 Panthéon-Sorbonne)

On a Simple Equilibrium with Heterogenous Quasi-Hyperbolic Discounting Agents and Linear Decision Rules

– Urmee Khan (University of California, Riverside) (with Maxwell Stinchcombe, University of Texas)

Planning For the Long Run: Programming with Patient, Pareto Responsive Preferences

– Mitri Kitti (University of Turku)

Equilibrium Payoffs for Pure Strategies in Repeated Game

– Łukasz Woźny (Warsaw School of Economics)

Repeated Moral Hazard With Costly Self-Control

Political Economics I:

Alejandro Saporiti (University of Manchester) – Session Organizer

– Torrens, Gustavo Federico (Indiana University)

The Political Economy of Trade and Labor Mobility in a Ricardian World

– Zudenkova, Galina (University of Mannheim)

Electoral Accountability and Inter-District Externalities

– Nicolaas J. Vriend (Queen Mary, University of London) (with Nobuyuki Hanaki, Université Nice & Emily Tanimura, Université Paris 1)

The Principle of Minimum Differentiation Revisited: Return of the Median Voter

– Dario Debowicz (University of Manchester) (with Alejandro Saporiti, Swansea University & Yizhi Wang, University of Manchester)

Redistributive Politics, Power Sharing and Fairness

Political Economics II:

Alejandro Saporiti (University of Manchester) – Session Organizer

– Alvaro Forteza (Universidad de la República Uruguay) (with C. Noboa, Universidad de la República Uruguay)

Tolerance of Tax Evasion

– Andrei Gomberg, (ITAM)

Ignorance and Bias in Collective Decision (with Alexander Elbittar, Cesar Martinelli and Thomas Palfrey)

– Anke Kessle (Simon Fraser University)

The Ideology Trap

– Jorge M. Streb (Universidad del CEMA)

Credible signals: A refinement of perfect Bayesian equilibria

Public Economics and Networks:

Nizar Allouch (Queen Mary, University of London, UK) – Session Organizer

– Nizar Allouch (Queen Mary, University of London, UK)

Aggregation in Networks

– Timo Hiller (Bristol University)

Friends and Enemies: A Model of Signed Network Formation

– Liuchun Deng (John Hopkins University)

Criminal Network Formation and Optimal Detection Policy: The Role of Cascade of Detection

Quantitative Macroeconomics 1:

Selahattin Imrohoroglu (University of Southern California, USA) – Session Organizer

– Pavel Brendler (European University Institute, Department of Economics)

Lifetime Earnings Inequality and Income Redistribution through Social Security

– Gary Hansen (UCLA, Department of Economics) (with Selo Imrohoroglu and Nao Sudo)

Replacing Income Taxation with Consumption Taxation in Japan

– Serena Rhee (University of Hawaii at Manoa, Department of Economics)(with Soojin Kim)

Measuring the Effects of Employment Protection for the Disabled: Theory and Evidence from the Americans with Disabilities Act

– Selo Imrohoroglu (USC, Marshall School of Business) (with Sagiri Kitao and Tomoaki Yamada)

Can Guest Workers Solve Japan´s Fiscal Problems?

Quantitative Macroeconomics 2:

Selahattin Imrohoroglu (University of Southern California, USA) – Session Organizer

– Julio Garin(University of Georgia, Terry College of Business) (with Robert Lester)

The Opportunity Cost of Employment and Search Intensity

– Oksana Leukhina (University of Washington, Department of Economics)(with Lutz Hendricks)

How Risky is College Investment?

– Gonzalo Paz Pardo (University College London) (with Maria Cristina De Nardi and Giulio Fella)

The Implications of Richer Earnings Dynamics for Consumption, Wealth, and Welfare

– Nuray Akin (Ozyegin University, Graduate School of Business)

An Equilibrium Search Model of Fire Sales

Repo and Intermediation:

Piero Gottardi (European University Institute, Italy) – Session Organizer

– Cyril Monnet (Bern, Switzerland) (with P. Gottardi & V. Maurin)

A Theory of Repurchase Agreements, Collateral Re-Use and Repo Intermediation

– Mario Pascoa (University of Surrey, UK) (with J.M. Bottazzi, Capula & J. Luque, U.Wisconsin – Madison)

Repo, leverage and security bubbles

– Piero Gottardi (European University Institute, Italy) (with D. Gale)

Equilibrium Theory of Banks’ Capital Structure

Revealed Preference and Monotone Comparative Statics:

John Quah (Johns Hopkins University & National University of Singapore) – Session Organizer

– Gregorio Curello (University of Oxford)

Comparative statics and informativeness under distributional constraints

– Xinxi Song (CUEB, Beijing) (with Andres Carvajal)

Non-parametric tests for Pareto efficiency and competitive equilibrium in economies with public goods

– John Rehbeck (UC San Diego)

Revealed Preference Analysis of Characteristics in Discrete Choice

– Pawel Dziewulski (University of Oxford) (with John K.-H. Quah)

Supermodular correspondences

Search and Sequential-Service Frictions in Models of Money and Banking:

Ricardo Cavalcanti (FGV/EPGE, Brazil) – Session Organizer

– Jefferson Bertolai (University of São Paulo, FEARP) (with R. Cavalcanti & P. Monteiro)

A Linear Programming Approach for Steady-State Optima in a Matching Model of Money

– Alexandre Janiak (Catholic University of Chile)

On the Welfare Cost of Bank Concentration

– Ricardo Cavalcanti (FGV/EPGE, Brazil) (with Fernando Barros Jr & Caio Teles)

A Paradox of Expansionary Policies

Security Design and Derivative Pricing:

José Fajardo (EBAPE/FGV, Rio de Janeiro) – Session Organizer

– Yuri Saporito (FGV/EMAp)

Functional Ito Calculus, Path-dependence and the Computation of Greeks

– Ernesto Mordecki (Universidad de la República del Uruguay – CMAT) (with Yuliya Mishura)

Optimal stopping for Levy processes with one-sided solutions

– Gustavo Manso (University of California, Berkeley)

Heterogeneous Innovation over the Business Cycle

– José Fajardo (EBAPE/FGV, Rio de Janeiro)

Barrier and Power style Contracts under Lévy processes

Social Choice and Cooperative Game Theory:

Youngsub Chun (Seoul National University, Korea) – Session Organizer

– Sebastian Cea (Paris School of Economics, University of Paris 1) (with Michel Grabisch, Université Paris 1)

Stochastic coalition formation processes with externalities

– Colin Rowat (University of Birmingham) (with Manfred Kerber, University of Birmingham & Naoki Yoshihara, Umass Amherst and Hitotsubashi University)

Asymmetric three agent majority pillage games

– Nejat Anbarci (Deakin University) (with Kang Rong, Shanghai University of Finance and Economics & Jaideep Roy, Deakin University)

Endogenous continuation with random arbitration in bargaining and the Nash solution

Stochastic Choice & Behavioral Optimization:

Paulo Natenzon (Washington University in St. Louis, USA) – Session Organizer

– Junnan He (Washington University in St. Louis)

Imperfect perception of attributes and contextual choice effects

Strategic Behavior in Markets and Auctions:

Marzena Rostek (University of Wisconsin, USA) – Session Organizer

– Tommaso Denti (MIT)

Games with Unrestricted Information Acquisition

– Jeongmin (Mina) Lee (Washington University in St. Louis, Olin School of Business) (with Pete Kyle (University of Maryland)

Information Aggregation with Symmetry

-Piero Gottardi (EUI) (with Sarah Auster, Bocconi University)

Competing Mechanisms in Markets for Lemons

– Kyle Woodward (UNC, Chapel Hill)

Strategic Ironing in Pay-as-Bid Auctions: Equilibrium Existence with Private Information

Supermodular Games:

Rabah Amir (Iowa) – Session Organizer

– Luciano De Castro (Iowa) (with R. Amir)

Games with quasi-monotonic best replies

– Adriana Gama (El Colegio de México) (with R. Amir)

Cournot oligopoly with firm-specific network effects

– Rabah Amir (Iowa) (with P. Erickson & J. Jin)

On the micro-economic foundations of linear demand

Temporal Preferences:

Jean-Pierre Drugeon (Paris School of Economics and CNRS) – Session Organizer

– Asen Kochov (University of Rochester) (co-authored with Antoine Bommier and François Le Grand)

Ambiguity and Correlation Aversion

– Carmen Camacho (Paris School of Economics and CNRS)

On Time Perception

– Daniel Gottlieb (Washington University in St. Louis) (co-authored with Pietro Ortoleva and David Dillenberger)

On Time and Risk Preferences

– Jawwad Noor (Boston University) (co-authored with Norio Takeoka)

Cognitive Foundations for Impatience

The Industrial Organization of Financial Service Providers in Developing Countries:

Robert Townsend (MIT) – Session Organizer

– Juliano Assunção (PUC- Rio) (with Sergey Mityakov & Robert M. Townsend)

Ownership matters: the geographical dynamics of BAAC and commercial banks in Thailand

– Gustavo Joaquim (MIT) (with Robert M. Townsend & Victor V. Zhorin)

Spatial Competition Among Financial Service Providers and Optimal Contract Design

– Gabriel de Abreu Madeira (University of São Paulo) (with Fernando Kuwer, University of São Paulo)

Earmarked Credit and Misallocation

– Fabio Miessi Sanches (University of São Paulo) (with Daniel Silva Junior, LSE & Sorawoot Srisuma, University of Surrey)

Bank Privatization and Market Structure of the Banking Industry: Evidence from a Dynamic Structural Model

Topics in Economic Theory:

Svetlana Boyarchenko (University of Texas at Austin) – Session Organizer

– Daria Khromenkova (University of Mannheim)

Restless Strategic Experimentation

– Svetlana Boyarchenko (University of Texas at Austin)

Exit Game with Information Externalities

– Johannes Horner (Yale University) (with Nicolas Lambert, Stanford University)

Motivational Ratings

– Nicolas Klein (University of Montreal) (with Matthias Fahn, University of Munich)

Relational Contracts with Private Information: The Upside of Implicit Downsizing Costs

Topics in Economic Theory:

Tom Krebs (University of Mannheim, Germany) – Session Organizer

– Alexandre Belloni (Duke University, USA) (with Giuseppe Lopomo, Leslie Marx, and Roberto Steri)

Budget-Constrained Procurement

– Felix Kubler (University of Zürich, Switzerland) (joint with Johannes Brumm and D. Krycka)

Existence of Recursive Equilibrium in Stochastic Production Economies

– Tom Krebs (University of Mannheim, Germany) (joint with Sebastian Findeisen and Dominik Sachs)

Optimal Taxation with Moral Hazard and Risky Human Capital

Topics in Economic Theory & Industrial Organization:

Marta Faias (Universidade Nova de Lisboa, Portugal) & Juan Pablo Torres-Martinez (Universidad de Chile, Chile) – Session Organizers

– Damián Vergara Domínguez (Faculty of Economics and Business, University of Chile) (with Marco Rojas Olivares, Faculty of Economics and Business, University of Chile)

Ambiguity and Long-Run Cooperation

– Joana Resende (CEF.UP, Universidade do Porto, Portugal) (with Didier Laussel, Université of Aix-Marseille)

Complementary Monopolies with Asymmetric Information

– Hagen Schwerin (Center for Economic Research at ETH Zurich (CER-ETH), Switzerland)

Swap Bonds or Stocks! A Game of Implicit Environmental Policy

– Marta Faias (Faculty of Sciences and Technology, Universidade Nova de Lisboa, Portugal) (with Juan Pablo Torres-Martínez, Faculty of Economics and Business, University of Chile)

Credit Market Segmentation, Essentiality of Commodities, and Supermodularity

Topics in Game Theory:

Yi-Chun Chen (National University of Singapore, Singapore) & Xiao Luo (National University of Singapore, Singapore) – Session Organizers

– Effrosyni Diamantoui (Concordia University, diamantoudi@gmail.com) (with Sheridon Elliston, Concordia University)

Monetary Unions – Stability and Issue Linkage

– Yongchuan Qiao (National University of Singapore, qiaoyongchuan@gmail.com) (with Xiao Luo, National University of Singapore; Chih-Chun Yang (Academia Sinica, Taiwan)

Bayesian Coalitional Rationalizability: An Epistemic Characterization

– Chenghu Ma (Fudan University, China, machenghu@fudan.edu.cn)

Short Selling and Security Lending under few Large Security Lenders

Topics in Market with Adverse Selection:

Humberto Moreira (FGV/EPGE) – Session Organizer

– Vitor Farinha Luz (UBC)

Robust Selling Mechanism

– Lucas Maestri (FGV/EPGE)

Optimal Mirrleesian Taxation in Non-Competitive Labor Markets

– Vinicius Carrasco (PUC-Rio)

Robust Decison Making

– Daniel Gottlieb (Olin Business School, Washington University)

Perfect Competition in Markets with Adverse Selection

Topics on economic growth and development:

Tiago Cavalcanti (University of Cambridge & FGV-SP ) – Session Organizer

– Julieta Caunedo (Cornell) (with Emircan Yurdagul)

Who Quits Next? Firm Growth in Growing Economies

– Cezar Santos (FGV-RJ) (with Leandro de Magalhães, Ardina Hasanbasri & Raul Santaeulalia-Llopis)

Marital Sorting, Resource Misallocation, and Agricultural Productivity

– Anne Villamil (University of Iowa) (with Zhigang Feng)

How a Regressive Subsidy to Employment-Based Health Insurance Enhances Entrepreneurship and Improves Welfare

– Tiago Cavalcanti (University of Cambridge & FGV-SP ) (with Georgi Kocharkov & Cezar Santos)

Family Planning and Development: Aggregate Effects of Contraceptive Use

Asymmetric information, innovation and wages

Hugo Hopenhayn (UCLA, USA) – Session Organizer

– Venky Venkateswaran (NYU, USA)

Asymmetric information, Search Frictions and Liquidity

– Anna Luisa Pessoa Araujo (University of Minnesota, USA)

Impact of recall on wages

– Hugo Hopenhayn (UCLA, USA)

On the Direction of Innovation

Sir John Hicks Lecture

Timothy Kehoe (University of Minnesota, Federal Reserve Bank of Minneapolis & National Bureau of Economic Research)

Firm Entry and Exit and Aggregate Growth

David Cass Lecture

Robert E. Lucas, JR (University of Chicago)

What Was the Industrial Revolution?

Lionel Mckenzie Lecture

Nancy Stokey (University of Chicago)

The Race Between Technology and Human Capital

Special Lectures

Ricardo Mañé Auditorium

Wednesday, July 6th, 2016

Yves Balasko (University of York, UK)

Stability of equilibrium and market segmentation

Hour: 11:30 – 12:30

Paulo Klinger Monteiro (EPGE-FGV)

Unifying bank-run theories and the trap of financial integration

Hour: 12:45 – 13:30

Saturday, July 9th, 2016

Alain Chateauneuf (PSE-University of Paris I)

About delay aversion

Hour: 10:00 – 10:45

Mario Pascoa (University of Surrey)

Equilibrium in FX swap markets: analogy with repo, funding pressures and the cross currency basis

Hour: 10:45 – 11:30

Michael Woodford (Columbia University)

Rational Inattention with Sequential Information Sampling

Hour: 16:00 – 17:00

Felix Kubler (University of Zürich, Switzerland)

Simple equilibria in OLG models with boundedly rational agents and collateral constraints

Hour: 17:15 – 18:15

Aloisio Araujo (IMPA and FGV-EPGE)

Hour: 18:15 – 19:15

Session Organizers

Cuong Le Van (University of Paris I)

Asset bubbles and Economic Growth

Rafael Chaves Santos (Banco Central do Brasil)

Central Bank Session: theoretical and empirical assessments to assist the CB decisions

Armando Gomes (Olin School of Business, Washington University in St. Louis, USA)

Coalition and Network Formation

Dan Kovenock (Chapman University, USA)

Contests I & Contests II

Brian A. Roberson (Purdue University)

Contests and Applications

Igor Livshits (University of Western Ontario, Canada)

Debt and Default: Fluctuations and Trends

Jack Stecher (Carnegie Mellon University, USA)

Decision theory & Coordination games

Simone Cerreia-Vioglio (Università Bocconi, Italy)

Decision under Uncertainty

Takashi Kamihigashi (Kobe University)

Development/Environment Dynamics and Unemployment

Johannes Horner (Yale University, USA)

Dynamic Games

Richard P. McLean (Rutgers University)

Dynamic games with incomplete information

Juan Pablo Rincon-Zapatero (Universidad Carlos III de Madrid, Spain)

Dynamic Programming

Sergio Pinheiro Firpo (Insper, Brazil)

Econometric Methods

Wilfredo Maldonado (Universidade Católica de Brasília) & Alberto Pinto (Universidade do Porto)

Economic Dynamics

Nicholas Yannelis (The University of Iowa, Iowa City)

Economic Theory I

Jean-Marc Bonnisseau (Paris School of Economics)

Economic Theory II

Luis Henrique Bertolino Braido (FGV)

Economic Theory and Applications

Tai-Wei Hu (Northwestern University, USA)

Economics of learning and information

Frank Page (Indiana University, USA)

Endogenous Systemic Risk & Over the Counter Markets specifically on network formation game models of such markets

Roger Guesnerie (Collège de France, France)

Expectations and learning

Alain Chateauneuf (PSE-University of Paris I, France) & Bernard Cornet (PSE-University of Paris I & University of Kansas, France & USA)

Finance and decision

Mario Pascoa (University of Surrey, UK)

Financial and monetary equilibria contributions by former IMPA students

Timothy Kehoe (Univ. of Minnesota / Federal Reserve Bank of Minneapolis, USA)

Firm Dynamics and the Macroeconomy

Yves Balasko (University of York, UK)

General Equilibrium

Carlos Hervés-Beloso (University of Vigo, Spain)

General equilibrium and externalities

Cecilia Testa (University of London, UK)

Government, Institutions and Public Policy

Timothy Kehoe (Univ. of Minnesota / Federal Reserve Bank of Minneapolis, USA)

Household Behavior and the Macroeconomy

Steffen Lippert (University of Auckland, New Zealand)

Industrial Organization

Xavier Vives (IESE Business School, Spain)

Information Aggregation and Welfare

José Alvaro Rodrigues-Neto (Australian National University)

Information and Decisions

Timothy Kehoe (Univ. of Minnesota / Federal Reserve Bank of Minneapolis, USA)

International Capital Flows

Giovanni Facchini (University of Nottingham, UK)

International Trade

Timothy Kehoe (Univ. of Minnesota / Federal Reserve Bank of Minneapolis, USA)

International Trade

Kyle Herkenhoff (University of Minnesota, USA)

Macro Perspectives

Eduardo Azevedo (Wharton School, USA) & Andrés Carvajal (EPGE-FGV, Brazil)

Matching markets and Insurance

Daniela Puzzello (Indiana University, USA)

Monetary Economics

Tarun Sabarwal (Kansas University, USA)

Monotone Methods

Walter Trockel (Bielefeld University, Germany)

Nash Program and Implementation

Francis Bloch (Ecole Polytechnique, France)

Networks

Kevin Reffett (Arizona State University, USA) & Lukasz Wozny (Warsaw School of Economics, Poland)

New Methods for Dynamic Economies 1 & New Methods for Dynamic Economies 2

Alejandro Saporiti (Manchester)

Political Economy

Nizar Allouch (Queen Mary, University of London, UK)

Public Economics and Networks

Selahattin Imrohoroglu (University of Southern California, USA)

Quantitative Macroeconomics I & II

Piero Gottardi (European University Institute, Italy)

Repo and Intermediation

John Quah (Johns Hopkins University & National University of Singapore)

Revealed preference and monotone comparative statics

Ricardo Cavalcanti (FGV/EPGE, Brazil)

Search and Sequential-Service Frictions in Models of Money and Banking

José Fajardo (EBAPE/FGV, Rio de Janeiro)

Security Design and Derivative Pricing

Youngsub Chun (Seoul National University, Korea)

Social Choice and Cooperative Game Theory

Paulo Natenzon (Washington University in St. Louis, USA)

Stochastic Choice & Behavioral Optimization

Marzena Rostek (University of Wisconsin, USA)

Strategic Behavior in Markets and Auctions

Jean-Pierre Drugeon (PSE, France)

Temporal Preferences

Svetlana Boyarchenko (University of Texas, Austin)

Topics in Economic Theory

Marta Faias (Universidade Nova de Lisboa, Portugal) & Juan Pablo Torres-Martinez (Universidad de Chile, Chile)

Topics in Economic Theory & Industrial Organization

Yi-Chun Chen (National University of Singapore, Singapore) & Xiao Luo (National University of Singapore, Singapore)

Topics in Game Theory

Tiago Cavalcante (University of Cambridge, UK)

Topics on economic growth and development

Beth Allen (University of Minnesota, USA)

TBA

Rabah Amir (University of Iowa, USA)

TBA

John Duggan (University of Rochester, US)

TBA

Hugo Hopenhayn (University of California, USA)

TBA

Richard McLean (Rutgers University, USA)

TBA

Pablo Andrés Neumeyer (Universidad Torcuato Di Tella, Argentina)

TBA

Alvaro Sandroni (Kellogg, USA)

TBA

Marcelo Santos (Insper, Brazil)

TBA

Chris Shannon (University of California-Berkeley, USA)

TBA

Takashi Kamihigashi (Kobe University, Japan)

TBA

Richard Suen (University of Leicester, UK)

TBA

Eric W. Bond (Vanderbilt University)

TBA

Tom Krebs (University of Mannheim, Germany)

TBA

*Incomplete

Submissions

In order to submit a scientific paper to be presented in forthcoming SAET Conference, please contact a Session Organizer through the link below:

Social Events

- Conference Gala Dinner

*Date to be announced

- July 10th, 2016

***With additional fee

Bus tour to the Port of Rio de Janeiro, renewed for the Olympic Games (Porto Maravilha) with visits to:

Museum of Tomorrow

www.museudoamanha.com – designed by Santiago Calatrava

and

MAR – Rio Art Museum

www.museudeartedorio.com

Joint lunch for both PET and SAET participants.

PET 2016 event in Rio July 11-13, 2016

Previous SAET events

Sponsors:

Postal Address: Instituto Nacional de Matemática Pura e Aplicada

Estrada Dona Castorina 110, Jardim Botânico

Rio de Janeiro, RJ, CEP 22460-320, Brasil

E-mail: eventos@impa.br